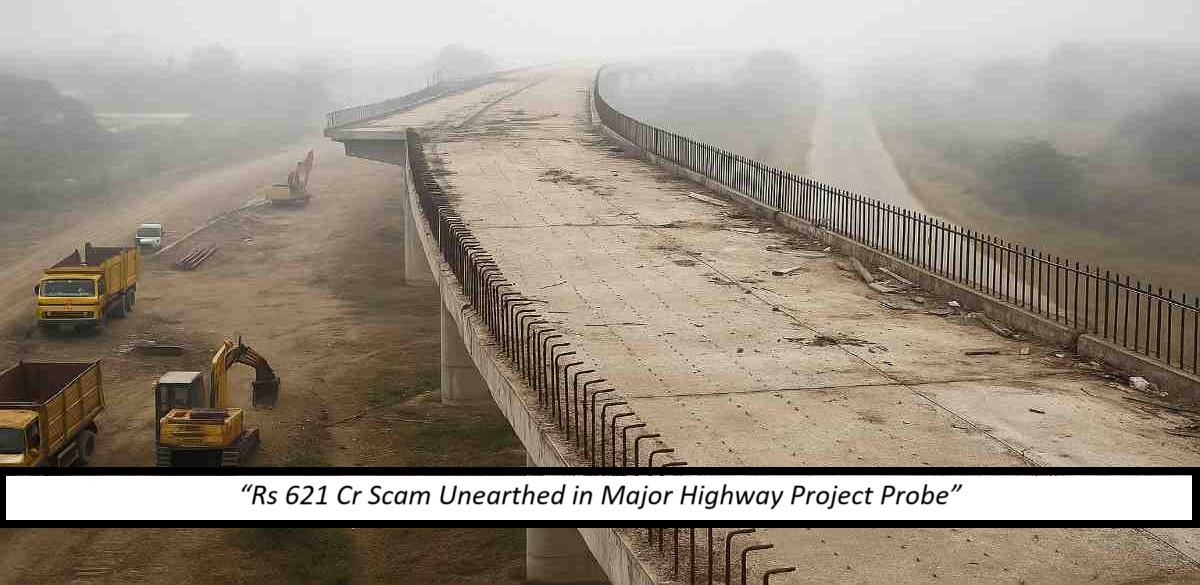

Raids Conducted Across 6 Locations; 33 Bank Accounts Frozen in Massive Loan Diversion Scam.

The Enforcement Directorate (ED) has launched a major crackdown in Hyderabad, raiding six premises connected to a ₹621.78 crore bank fraud case involving SEW LSY Highways Ltd and associated companies.

The investigation stems from a Central Bureau of Investigation (CBI) FIR accusing the company’s promoters and directors of loan siphoning, cheating, and criminal misconduct related to a high-value infrastructure project in Uttar Pradesh.

🔍 What Is the Scam About?

- SEW LSY Highways Ltd was set up as a Special Purpose Vehicle (SPV) to build a highway under the Uttar Pradesh State Highway Authority.

- The project was backed by a ₹1,700 crore term loan from a 14-bank consortium led by Punjab National Bank (PNB).

- Of this, ₹603.68 crore was disbursed, but the project remained incomplete and the loan turned into an NPA (Non-Performing Asset).

🕵️♂️ What ED Found

According to the ED:

- The funds were diverted using intra-group sub-contracting, primarily through SEW Transport Networks Ltd (STNL) and then on to Prasad & Company (PSPWPL).

- PSPWPL allegedly funneled the money back into the system as “promoter contribution,” violating lending conditions.

- 33 bank accounts related to SEW Infrastructure Ltd, its directors, and their family members have been frozen.

👥 Who’s Involved?

- SEW Infrastructure Ltd, founded in 1983 by Vallurupalli Nageswara Rao, is the parent company at the heart of the investigation.

- The probe also involves group firms and senior executives, though no arrests have been reported yet.

⚠️ Why This Matters

- The case reflects the widening crackdown on corporate loan fraud in India, especially in the infrastructure and real estate sectors.

- With the banking sector already under pressure, such NPAs contribute to massive losses of public money.

- The use of circular funding and layered sub-contracting to mask misappropriation is a growing red flag for regulators.

🧊 Assets Frozen So Far

- 33 accounts frozen (belonging to the accused companies and individuals).

- Further action is expected as the investigation unfolds.

📰 Conclusion

The ₹621 crore highway project scam is yet another reminder of the urgent need for transparency, stricter auditing, and better oversight in government-backed infrastructure ventures.

As India pushes forward on its ambitious road development agenda, the watchdogs are watching—closely.